Mirado Project

About Mirado

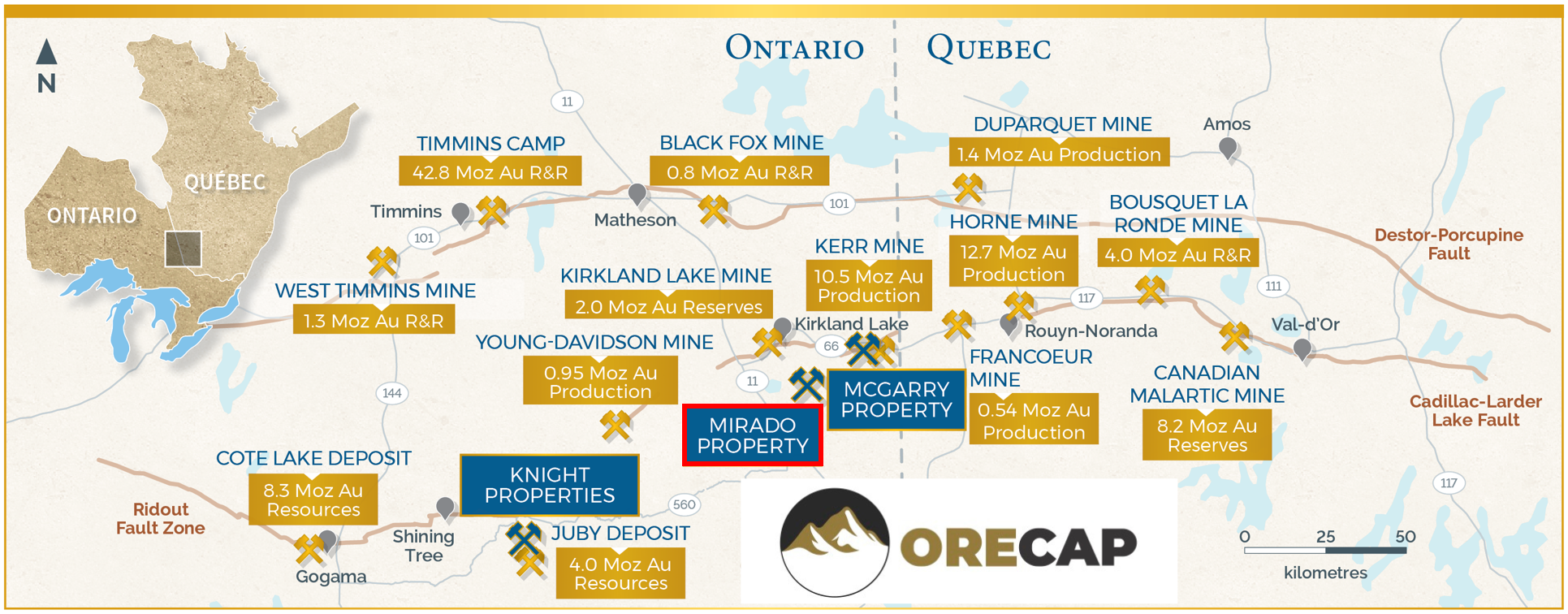

Mirado Mine is a past producing underground gold mine located 35km SE of Kirkland Lake, and is easily accessible via road. Mirado is proximal to numerous operations including Macassa, Young-Davidson, Holt, Black Fox, and Westwood. Mirado deposit interpreted to be a gold rich VMS system with a gold-rich stringer footwall (South Zone) overlain by a zinc and gold-rich bedded hanging wall (North Zone).

History of Mirado

Gold on the Mirado Gold Property was first discovered in the early 1920s and later mined by underground methods to a depth of 500′ in the 1940s. Several exploration programs, diamond drilling campaigns, and underground and open pit mining activities have taken place since then. Over the years, over 40,000m of drilling was completed by several companies, including Mirado Nickel Mines, Broulan Reef, Amax Minerals Exploration, and Golden Shield Resources Inc (Golden Shield).

The previous work can be reviewed in historic reports on the Ontario government website, including an environmental base line study, bulk sampling, stockpiling of open pit and underground material, and metallurgical test-work programs. Golden Shield contracted Dynatec Mining Ltd. in 1986 for underground and open-pit operations. Much of the Mirado south zone was pre-stripped, and an open pit was mined to a depth of 30m. The material removed from the pit was stockpiled on the Mirado property, where it remains today.

Metallurgical test-work was undertaken under the supervision of A. S. Hayden of EH Associates in 1986. Settling and filtration tests were conducted, and Lakefield Research prepared test slurries. A study of three alternative metallurgical processes was undertaken, including (1) selective flotation with cyanidation of concentrate; (2) direct cyanidation of ore with Merrill- Crowe recovery; and (3) direct cyanidation of ore, with carbon in pulp gold recovery. Gold recoveries up to 95% were realized.

Location and Infrastructure

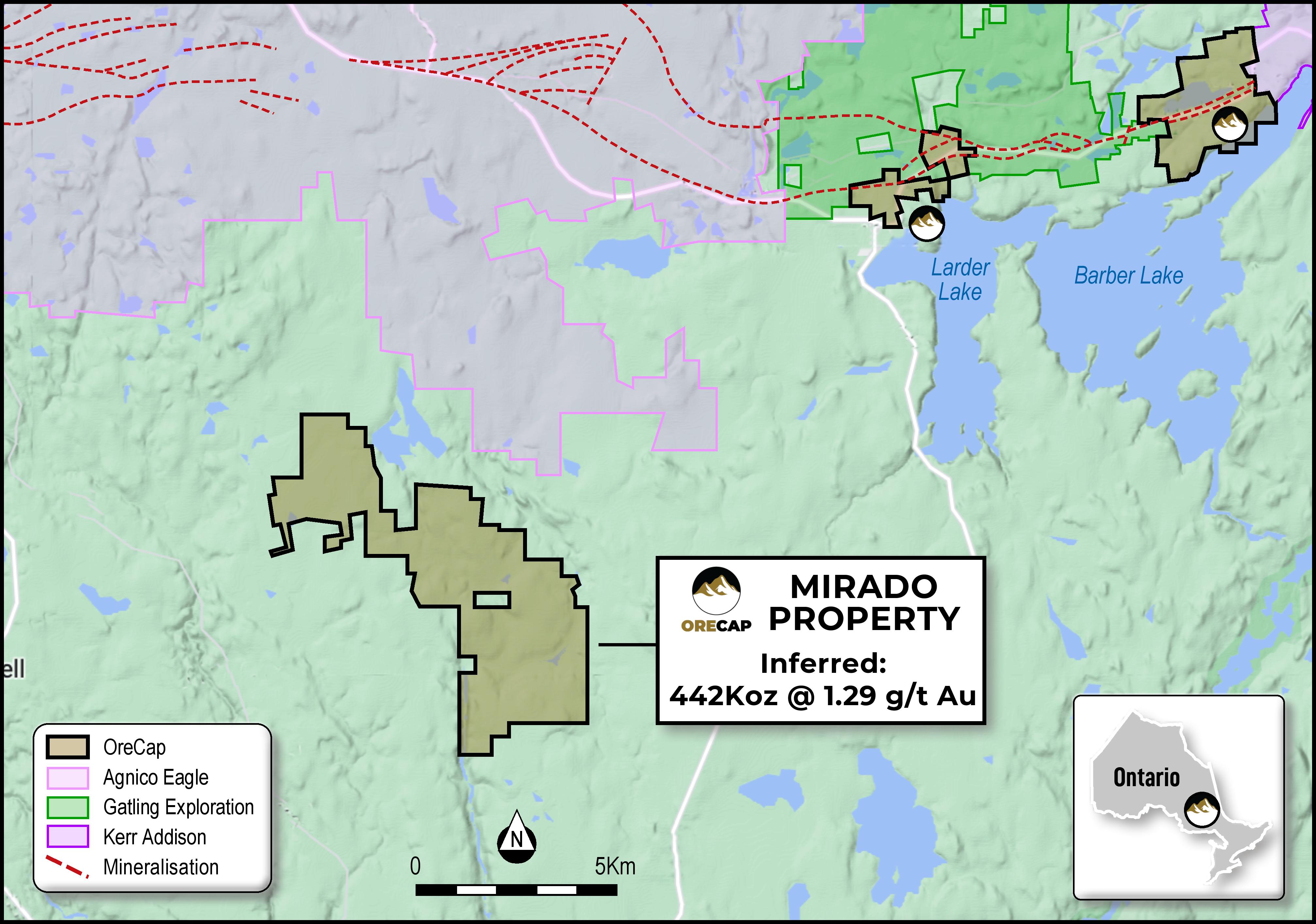

The Mirado gold project is located 35 km southeast of the gold mining town of Kirkland Lake in northeastern Ontario. The entire Mirado property encompasses 5,800 acres. The focus of the Mirado Gold Project consists of 12 contiguous patented claims, with surface and mining rights, owned 100% by Orefinders.

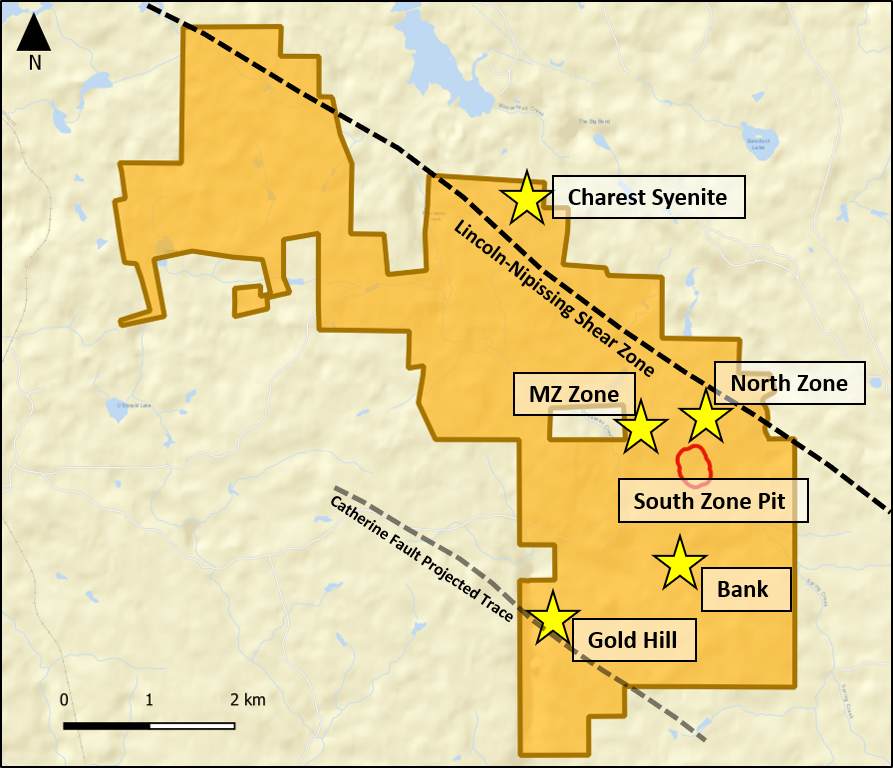

Surrounding the core patented claims, ORECAP has optioned and/or staked 37 additional contiguous claims covering approximately 10 km of prospective strike length. Amongst these claims is ORECAP's 100% owned MZ property, which forms the Mirado Mine's western extension in-pit resource.

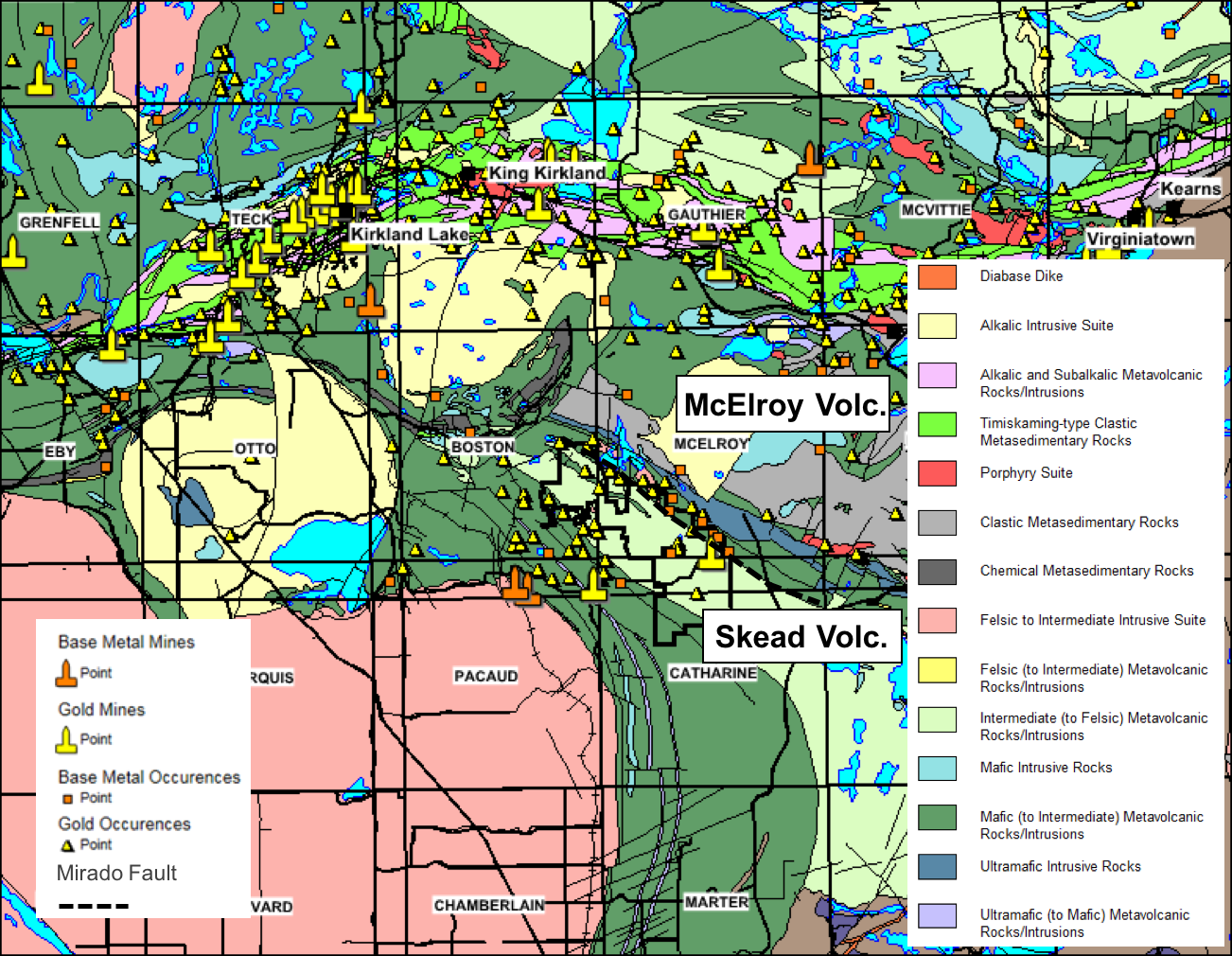

The Mirado gold project is situated within the Abitibi Gold District, which has historically produced more than 200 million ounces of gold over the past century, with more than 100 million ounces of gold in current reserves. The prolific Kirkland Lake mining camp is located in eastern Ontario close to the Quebec border and has historically produced 50 million ounces of gold. Much of the historical Kirkland Lake gold production has taken place along or near a major regional geological fault structure known as the Larder Lake-Cadillac Fault (LLCF).

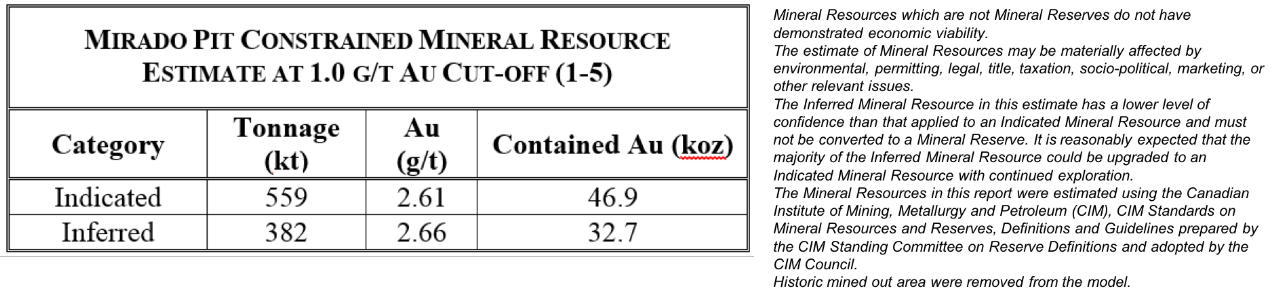

Mineral Resources

The Project is considered economically viable with the current Mineral Resource Estimate of 559,000 tonnes at an average grade of 2.61 g/t gold for 46,900 ounces of Indicated Mineral Resource and additional Inferred Mineral Resource of 382,000 tonnes at an average grade of 2.66 g/t gold for 32,700 ounces, based on a cut-off grade of 1.0 g/t gold.

Property Geology

The regional geological map above indicates the Mirado property's location in relation to the major gold deposits located along or near the LLCF. Mirado property is favourably located near the top of an Achaean intermediate to felsic, fragmental calc-alkaline volcanic sequence known as the Skead Assemblage. Gold mineralization is structurally controlled and has been identified along NW-SE trending shear zones. North-South brittle structures have also been recognized on the property as being favourable for gold mineralization. A regional northwest-trending fault defines the upper contact of the Skead Assemblage. This faulted contact is situated on the northern half of the property.

Maps & Sections

Numerous other zones of interest beyond the scope of PEA:

North Zone (MNZ): high priority drill target situated in a very favourable geological environment where a sizeable gold and polymetallic deposit can be developed.

South Zone at Depth (MSZD) and MZ Zone: High-value drill targets identified from trenching at MZ (21.8 g/t Gold over 4.80 metres).

Gold Hill: grab sampling identified vein system at the surface—100m along strike and returned up to 26.8 g/t Gold; veins are open at depth and along strike.

Bank: Discovery on the surface with narrow high-grade polymetallic vein traced for over 30 metres in length, averaging 4.8 g/t Gold up to 80 cm wide.

Charest Syenite and Nipissing Shear Zone: intrusion with gold-rich quartz veins—grab samples returned 14.8 g/t, 10.6 g/t and 1.98 g/t Gold; syenite intrusive bodies are well known in the Abitibi to host large gold deposits. Nipissing shear contact is highly deformed, altered and mineralized over a 6km strike.

3D Models

Technical Reports

In January 2018, ORECAP announced its Preliminary Economic Assessment for the South Zone Open Pit part of the Mirado Gold Mine, located to the southeast of Kirkland Lake, Ontario. Further details available on our news release of January 15, 2018.

This PEA considers the only production from a specific area, encompassing approximately five percent of ORECAPS's Mirado Project. The Mineral Resource contemplated within this PEA for mining is within the South Zone's open pit. It is near surface mineralization that can be economically mined within a relatively short time frame and without using an on-site processing or tailings facility. The Company intends to use the free cash flow from this operation to develop what it sees as the true upside potential on the broader Mirado Project and other assets it owns.

This PEA's economics indicates an after-tax internal rate of return ("IRR") for the Project of 158% and a pre-tax undiscounted Net Present Value ("NPV") of $30.8 million and a $20.5 million after-tax NPV at a 5% discount rate. Payback on capital is reported at seven months. The average gold price used is US$1,300 per ounce and an exchange rate of 1.00 USD =0.76 CAD.

The initial preproduction expenditure is estimated at $2.4 million to achieve the first production from the open pit. The project life is three years, after approximately six months of open-pit pre-stripping. The Life of Mine ("LOM") cash operating cost is US$941 per ounce of gold, and the LOM all-in sustaining cost is US$969 per ounce of gold.