News Releases

Orecap Closes Acquisition of Ontario's Largest Copper Resource, Thierry Copper Mine

Toronto, Ontario – October 31, 2023 – Orecap Invest Corp. (the "Company" or "Orecap") (TSX.V: OCI) (OTC: ORFDF) is pleased to announce the closing of a controlling interest in a private company that owns 100% of Thierry Copper Mine ("Thierry"), located in Pickle Lake, Ontario.

Thierry is Ontario’s largest primary copper resource and includes a recent PEA covering only the underground portion of the known resources. Orecap’s view is that Thierry’s primary upside is its near-surface bulk tonnage potential growth. Thierry reflects Orecap’s strategy of acquiring opportunities from special situations and incubating new high-potential brownfield projects with excellent infrastructure and jurisdictions. Recent drill holes from September 20, 2023 support this view:

- CCM-23-51 intersecting 106 metres of 0.539% Copper Equivalent (“CuEq”) mineralization (including 23.2 metres of 0.875 % CuEq mineralization) within continuous sulphide mineralization which started at surface and extended 247.8 metres down the hole, grading 0.438% CuEq.

- CCM-23-52 intersecting 31.2 metres of 0.677% CuEq mineralization and 22.8 metres of 0.670% CuEq mineralization within continuous sulphide mineralization which started at surface and continued for 243.9 metres down the hole, grading at 0.382% CuEq.

*Copper Equivalent (CuEq) for drill intersections is calculated based on US$ 3.75/lb Cu, US$ 9.25/lb Ni, US$ 1,190/oz Pd and US$ 910/oz Pt with 100% metallurgical recoveries for all metals. Assays have not been capped. The formula used for the calculation is: CuEq = Cu % + (Ni grade X Ni Price)/(Cu Price) + ((Pd grade) X (Pd price / 31)) / (Cu price X 22 ) + ((Pt grade) X (Pt price/31)) / (Cu price X 22).

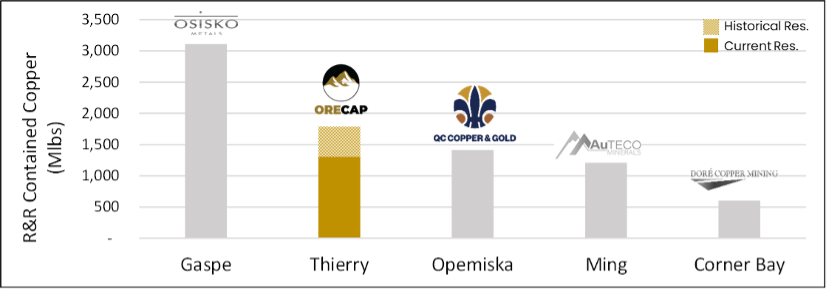

Eastern Canada Copper Projects - Figure 1

Thierry is in the mature mining district of Pickle Lake, Ontario, with access to rail, highways, power, and other infrastructure required to develop a mine. This is a unique opportunity to develop an asset of this scale with this level of infrastructure that’s in a premier mining jurisdiction. With Orecap now controlling the second largest primary copper project in the region, the Ore Group collectively controls two of the five largest primary copper projects in Eastern Canada.

CLICK HERE TO VIEW ORECAP’S THIERRY PROJECT PRESENTATION

About Thierry

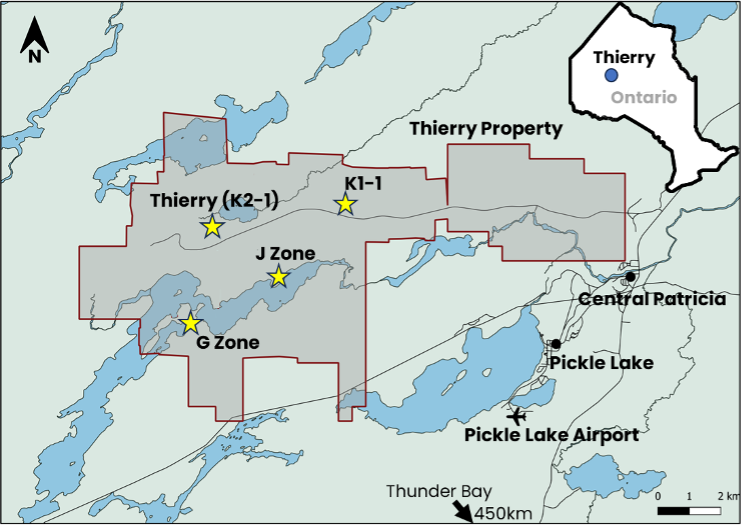

Thierry spans 4,670 hectares across 27 mineral leases. The property hosts two past-producing open pits that transitioned to underground mining—producing 5.8Mt @ 1.13% Cu, 0.14% Ni between 1976 – 1982 by UMEX Inc. Historically, copper concentrate was shipped to the Horne Smelter in Rouyn-Noranda, QC. Significant infrastructure is already in place, with the property being accessible via all-season road, an airport within 5km, available hydro, and nearby rail.

Location of Thierry Property - Figure 2

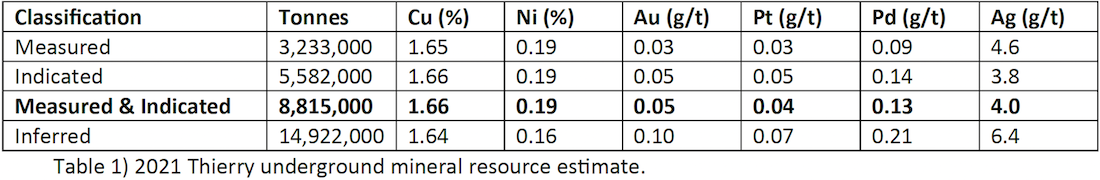

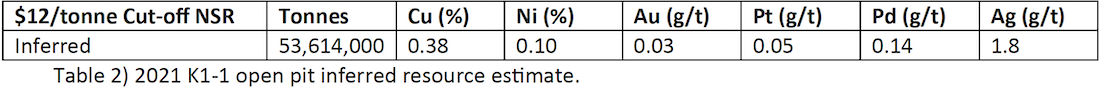

The Thierry property hosts a NI 43-101 compliant resource across two zones—the Thierry (K2-1) underground deposit, and the K1-1 open pit deposit, along with historical resources at the J & G Zones (see disclosure on Historical Resources):

Thierry (K2-1) underground deposit:

K1-1 Zone open pit deposit :

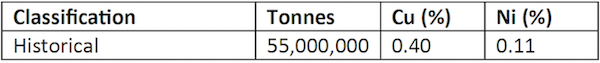

J & G Zones open pit deposit historical resources:

Thierry 2022 PEA

The Thierry Property, and specifically the Thierry underground deposit, was the subject of an updated PEA study by P&E Mining Consultants in April 2022 that outlined a 14-year mine life, producing at a rate of 4,000 tpd, recovering 567Mlbs Cu, and 21Mlbs Ni. The PEA showed an after-tax NPV6% of $287M, an IRR of 25% and a payback period of 3.1 years. It is important to note that the PEA did not include the K1-1 open pit deposit and that Orecap will seek to drill out the open pit resources and evaluate a larger bulk tonnage scenario for the Project (see disclosure on PEA in Historical Resources and PEA).

Exploration Upside

In addition to the current resources, the Thierry property hosts large discovery and expansion potential including at the J & G Zones, which hosts a historical resource of 55,000 kt at 0.40% Cu, 0.11% Ni (see disclosure on Historical Resources). Previous geophysical studies and drilling has shown significant upside throughout the property to delineate additional mineralized zones and resources. Moving forward, Orecap will focus on reinterpreting the geology at the Thierry property and delineate further resources that can then culminate into a comprehensive PEA representative of the property’s potential.

Terms of the Acquisition

Orecap has acquired 45% of Cuprum Corp. (formerly Pickle Lake Minerals Inc.) (“Cuprum”), a subsidiary of Canadian Critical Minerals Inc. (“CCMI”), for $1,350,000 in an upfront, all-cash deal, with CCMI also receiving 3,000,000 share purchase warrants of Cuprum with the following terms: 1,000,000 warrants with an exercise price of $0.10 per common share of Cuprum and exercisable for a period of 1 year from the closing date of this transaction (“Closing Date”); 1,000,000 warrants with an exercise price of $0.15 per common share of Cuprum and exercisable for a period of 2 years from Closing Date; and 1,000,000 warrants with an exercise price of $0.20 per common share of Cuprum and exercisable for a period of 3 years from Closing Date. Additionally, CCMI will receive a $500,000 milestone bonus payment for the completion of a new NI 43-101 resource on near surface (300 metres from surface) resources in excess of 100 million tonnes and/or 1.0 billion lbs of copper; and an additional $250,000 milestone bonus payment for the completion of a new NI 43-101 resource on near surface (300 metres from surface) resources in excess of 150 million tonnes and/or 1.5 billion lbs of copper. Concurrently, QC Copper And Gold Inc. (“QC Copper”), a company in which Orecap owns ~5 million shares or ~3%, has acquired 10% of Cuprum at the same valuation. Principals of Orecap and QC Copper ("Companies"), including Chairman Stephen Stewart, will co-invest alongside the Companies at the same valuation.

Information Regarding Historical Resources and PEA

Orecap views this historical data as a conceptual indication of the potential size and grade of the gold deposits in the area, and this data is relevant to ongoing exploration efforts. In view of when the resources were estimated and the differences in metal price and operating costs prevailing at the time compared to today, Orecap does not treat any of the historical resources as Current mineral resources or mineral reserves. Note that the PEA referred to above is historical in nature and Orecap has not conducted any economics analysis of the project and is using the conclusions of the PEA only as an indication of the potential economic performance of the project.

QP Statement

The technical information in this news release has been reviewed and approved by Charles Beaudry, P.Geo, Director for Orecap, who is a Qualified Person as defined in "National Instrument 43-101, Standards of Disclosure for Mineral Projects."

For the latest videos from Orecap, Ore Group, and all things Mining, subscribe to our YouTube Chanel: youtube.com/@theoregroup

For further information, please contact us:

Orecap Invest Corp.

Stephen Stewart, Chief Executive Officer

416.644.1567

sstewart@oregroup.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain information set forth in this news release contains forward-looking statements or information ("forward-looking statements)", including details about the business of the Company. All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements, including, but not limited to, the statements with respect to the Company's plans with respect the Thierry property. By their nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond the Company's control, including the impact of general economic conditions, industry conditions, volatility of commodity prices, currency fluctuations, environmental risks, operational risks, competition from other industry participants, stock market volatility. Although the Company believes that the expectations in its forward-looking statements are reasonable, its forward-looking statements have been based on factors and assumptions concerning future events which may prove to be inaccurate. Those factors and assumptions are based upon currently available information. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. Accordingly, readers are cautioned not to place undue reliance on the forward-looking statements, as no assurance can be provided as to future results, levels of activity or achievements. Risks, uncertainties, material assumptions and other factors that could affect actual results are discussed in the Company's public disclosure documents available at www.sedar.com.. Furthermore, the forward-looking statements contained in this document are made as of the date of this document and, except as required by applicable law, the Company does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. The forward-looking statements contained in this document are expressly qualified by this cautionary statement.